|

If Bitcoin reaches a price of $100,000 to $200,000, there will be more crypto-billionaires than *all* other kinds of billionaires...Combined. BTC reached nearly $65,000 this year, so Bitcoin at $100,000 is not that far off. Cryptocurrency will change the world in many ways but there’s one question no one seems to be asking: How will cryptocurrency wealth change philanthropy? And of particular interest to organizations looking to raise capital, what will crypto-philanthropists donate to? Let’s start with an example Crypto-Philanthropist Vitalik Buterin, creator of the second most valuable cryptocurrency, Ethereum, and worth an estimated $21B, recently made his first high profile donations totaling over $1B. His gifts included:

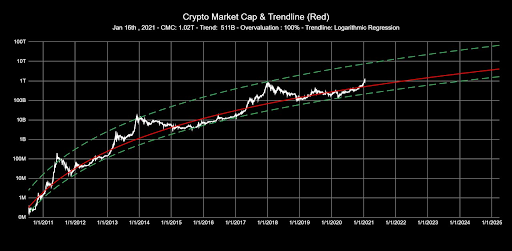

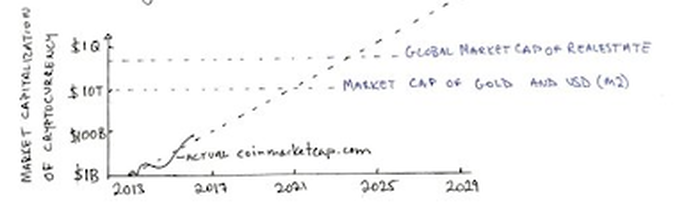

Life extension, artificial intelligence and autonomous city-states. These donations are...unusual. Let’s talk about some areas that crypto-philanthropists might focus on. Aligned Causes “Most of the people who bought crypto early on — they’re believers in the power of technology to change the world. They’re interested in the ethos of crypto in many cases, and I suspect that they would allocate their capital towards more things in that vein.” -Brian Armstrong, CEO of Coinbase, Interview with Tyler Cowan Crypto’s “ethos” has traditionally been libertarian: skepticism of fiat money and financial systems, a belief in privacy and anonymity as enabled by cryptography, in favor of minimal government regulation and taxation. Most the largest number of grants in the crypto currency space seem to be for other currencies and protocols like grants from Solana, Human Rights Watch and Kraken cryptocurrency exchange. While not everyone in the crypto-community today holds these views, remember that those who were able to accumulate the most crypto wealth necessarily got started right in the beginning. And to start in the beginning when Bitcoin was a risky bet they had strong philosophical motives. Risky Bets Crypto-Billionaires made their money by taking a risky bet. Their philanthropy might be characterized by similar levels of risk tolerance. Buterin’s donations (life extension, general AI, charter cities) suggest the same attitude is being applied to their donations. Risky bets in grant making couldn’t come at a better time. Traditional grant makers are criticized for being too adverse to moonshot proposals, funding incremental, low risk projects for older and older researchers. At the NIH, for example, the average age researchers obtain their first Research Project Grant was 35 in 1980; in 2016 it was 43. The crypto-community is younger. Nearly half of millennial millionaires have at least 25% of their wealth in cryptocurrencies. Cryptocurrency investing drops off for those 45 and up. It’s likely that early crypto-investors were young. A number of teenage crypto-millionaires have identified themselves. Fast decision making Money will also move faster. Institutional grantors take months to decide (6 to 18 months in our experience). Bitcoin has often risen or fallen 10x over the length of typical grant cycles. Those timelines won’t be acceptable for crypto-billionaires obsessed with the speed of transactions. But is fast grant making even possible? A number of tech leaders just experimented with grant speed in a Covid philanthropy project, FastGrants. As they describe it: The original vision was simple: an application form that would take scientists less than 30 minutes to complete and that would deliver funding decisions within 48 hours, with money following a few days later. This timeline would be radical to legacy grantors, but it’s natural in crypto. Prizes rather than grants With a grant, money is given to undertake a project. With a prize, money is awarded upon a project’s completion. Prizes have the virtue of always being tied to results. This has its parallels in the workings of cryptocurrencies themselves, where in currency is awarded to miners as a block reward for securing transactions. Prizes are already being seen in one of Balaji Srinivasan’s projects, 1729, where cryptocurrency is given to the winner of a prototyping challenge. For example $100k was granted to a decentralized inflation calculator. Again, a rather unusual grant topic. We would never see USAID or the Gates Foundation fund. And yet inflation is one of the biggest problems in the world, a regressive tax that poor from being able to rise up. Increased Pseudonymous granting Bitcoin was born out of the cypherpunk community of the 1990s. “Privacy is necessary for an open society in the electronic age” their manifesto reads. Most crypto-traders are pseudonymous. We do not know the person associated with almost any wallet. Crypto-billionaires may value their anonymity, both for legal and personal reasons. So they aren’t expecting their names on buildings, nor are they claiming charitable deductions. For example, the Pineapple Fund has donated $86m in bitcoin. We know exactly how much money they have donated, when they have donated, and to whom they have donated at this address on the Bitcoin blockchain: 3P3QsMVK89JBNqZQv5zMAKG8FK3kJM4rjt. But we don’t know the Fund’s benefactor. The next John D. Rockerfeller might be a string of numbers and letters. International Giving Only a small portion of US giving goes to international organizations, 6% according to Charity Navigator. But cryptocurrency is international. The community believes in the egalitarianism that emerges from cryptocurrency’s location independence: It doesn’t matter who you are or where you are; you can still buy cryptocurrency. Whereas grantor like USAID or Gates Foundation often specify which country someone must be registered in to receive grants, crypto grants often don’t care at all which country someone is based in. Effective Altruism Effective Altruism (EA), which encourages people to maximize the amount of good they do in their lives, is also rising in popularity in the crypto-community. A number of Buterin’s investments were connected to EA: MIRI is a favorite charity of EA, and he also made a donation to GiveWell, EA’s default charity evaluator. Another high profile crypto-billionaire, Sam Bankman-Fried, publicly identifies as an EA. He plans to give the vast majority of his wealth (now over $10B) to effective causes. Solving philanthropy’s Impact Crisis Right now, there is a quiet crisis in measuring impact in development projects. Here’s the problem: Let’s imagine that I receive two grants to plant trees. At the end of the year I report back to both them that we planted 100 trees. Each of those grantors now reports on their website: we funded the planting of 100 trees! But if you add up the claims on their websites that comes to 200 trees. Where did those extra trees come from? Obviously grantors try to prevent this sort of thing from happening, but it’s often difficult, especially as results get tangled up together (one pays for the labor and the other pays for the seedlings, for example). There’s also the additional problem of time scale: if 50 of the trees die the next year, neither grantor may ever know. Do they ever revise their websites? Unlikely. Crypto grantors would never stand for this. The point of the blockchain is you know for sure how much money is in each address. Could there be a Blockchain-ish way to enable grantees to certify the impact for a project? There might just be! NFTs are a smart contract on a blockchain to certify digital art or collectibles. This could be the same for impact. All impact these days is presented in a digital format (PDFs, Spreadsheets, dashboards, etc)--why not put it on a blockchain, just like jpeg NFT art? Some NFT art is just so satisfying, right? With an NFT, the seller, who gets paid in cryptocurrency, can then pay their subcontractors in cryptocurrency. If we apply this to philanthropy, this could solve a lot of reporting and transparency issues. If grantees use crypto currency to pay their subcontractors, the whole process of grant reporting would be as easy as pulling data from the blockchain. So when is all this going to happen? If anything holds true in the new world of cryptocurrency wealth, it may be the tendency of billionaires to hold out until most of their growth potential has past. Tech billionaires typically do most of their giving after they leave the company they’ve created and begin to liquidate their stock. Cryptocurrency investors still see an enormous amount of growth potential, so have little interest in cashing out now. But cryptocurrencies can’t grow forever. In fact, if we project the growth curve forward it looks like the growth is slowing down and by 2025 or 2030 most explosive growth might be over: In 2017 I predicted that cryptocurrency would reach a market capitalization of $10T. It has reached nearly $4T already this year (up from $100B when I made the prediction) so my prediction wasn’t that far off. When will crypto-billionaires really start donating? Let’s put some rough numbers to it: People who will become billionaires in cryptocurrency were probably between 20 and 30 when they invested around 2010. Now they are 30 to 40. Philanthropic endeavors tend to take off between 40 and 50. Finally, cryptocurrency will be a mature asset class (not growing in value as fast) in 5-10 years as well, which encourages people to spend rather than hold. So 2025 to 2030 is when we might expect philanthropy to start seeing the full influence of crypto-wealth.

What should I do to prepare? Here's a starting point:

Examples of Crypto-Grants

8 Comments

|

AuthorKyle founded Grant&Co after running a biogas company in Kenya for 5 years. We raised a lot of grant capital there. And now we help other entrepreneurs raise capital. Archives

November 2022

Categories |

RSS Feed

RSS Feed