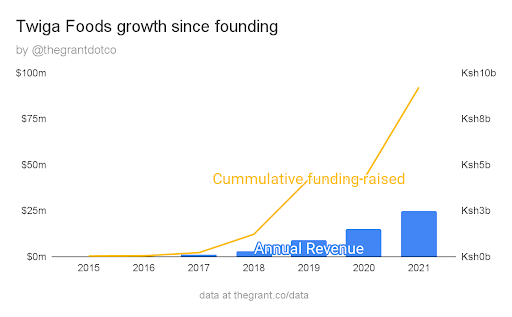

Twiga has raised ~Ksh10b (~$92m) and reached ~Ksh2.7b (~$25m) in annual revenue

But most people don’t know the behind the scenes story. Twiga is a perfect storm: great analysis, great team and great timing. What can we learn from them?

Twiga started with the most difficult suppliers (smallholder farmers) and most difficult buyers (informal markets). Meanwhile, all the other businesses sold to big chain supermarkets like Nakumatt or Tuskies or exported to Europe. So why take the contrarian approach? Kenyan smallholder farmers (<2Ha or <5acres of land) account for 78% (!!) of production in Kenya.

On the buy side, 70% of all produce in Kenya is sold in informal markets.

But no serious company would touch either smallholder farmers or informal markets with a 10 foot pole. Here’s why:

Small holder farmers are hard to buy from: they have small quantities and live down dirt roads, often impassable with big trucks. Imagine actually trying to drive through these “roads”

On my first overnight bus ride in Africa, we stopped at 2am. A truck had overturned and potatoes covered the narrow dirt road. All us men got out of the bus and cleared the potatoes so we could continue the journey. A wonderful story and fond memory—but bad for business.

Informal market buyers have no company registration, no address and can’t be invoiced. You can’t force loyalty or contracts: they buy what they need. If they don’t need bananas today they won’t. And if they can get a better price somewhere else they will. To serve these markets Twiga had to come up with a solution that paid farmers more, sold the product for less and was responsive to market demands such that Twiga would only buy bananas when there was a place to sell them. Oh, and btw, few of these buyers and sellers had bank accounts… Impossible to serve? Twiga had perfect timing. Mpesa mobile money and telecom infrastructure were so ubiquitous that software could finally connect all the pieces together. As they say, software is eating the world… And now we can say “Software is eating bananas”

But it wasn’t all rainbows and unicorns. The initial idea was to export bananas to Dubai. Twiga had an order for 20 containers. But they couldn’t fulfill it bc there were no standards on bananas in Kenya. Farmers didn’t know what they were growing.

Then Twiga brought a truckload of bananas to Nairobi but buyers wanted bananas in bunches, not crates. Buyers would eyeball bananas for size rather than weigh them. Then Twiga had a major insight: Wholesale price was Ksh4 per banana. Marketplace retail was Ksh10. But in housing developments the price was even more. Thus, a huge premium for delivering to the last mile, if delivery could be done efficiently. (For reference, in the US, bananas are ~$0.40/Ksh 45 each.) Little delivery Tuk-tuks enabled Twiga to deliver to micro-vendors that big trucks are uneconomical for.

Fruit vendors no longer woke up at 5am to avoid getting the worst quality produce—Twiga would deliver. Twiga was no longer competing on price, but convenience.

For farmers, Twiga created collection points with transparent pricing on sign-boards. Farmers were paid within 24 hours (!!) by Mpesa

In retrospect, selling to local, informal markets was a boon. By 2020, Tuskies and Nakumatt had fallen into severe arrears with suppliers and closed 92% and 100% (!!) of their stores, respectively. I have friends who delivered $1m (Ksh110m) worth of products to Nakumatt and lost everything.

Lesson: ?antifragility.? With many customers, Twiga was antifragile. If one customer failed to pay, there were more fish in the sea. Meanwhile, suppliers to Nakumatt were lulled into a false sense of security.

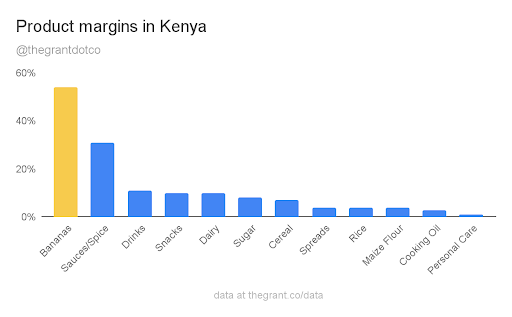

Not only did Twiga pursue the most difficult buyers and sellers, but also the most difficult product: Bananas bruise easily and have a short shelf life… why not sell shelf-stable rice?

Key lesson for all startups: Bananas have HUGE margins, precisely because they are so difficult. To become a high growth company ?you NEED high margins.? As Amazon CEO, Jeff Bezos, said “your margin is my opportunity”

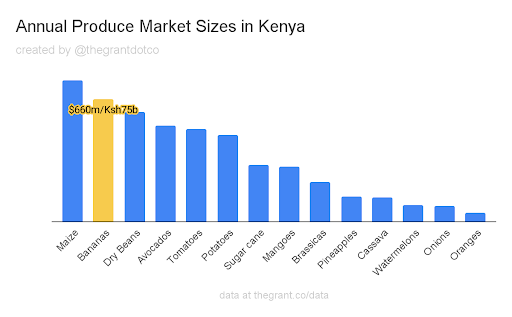

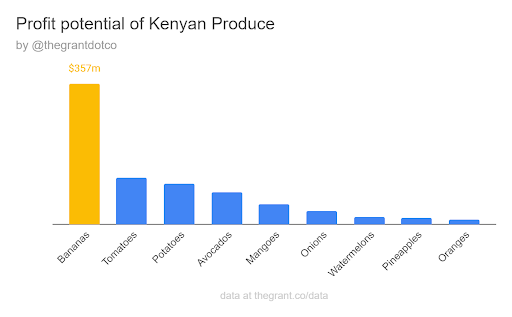

Moreover, bananas have the largest opportunity for distributors as they are one of the largest crops in Kenya

Twiga very intentionally chose bananas. Combining margins and market size, it has the largest opportunity:

?Principle: Anything with high margins is difficult to serve…currently. But if you can serve the market better, maybe if you use some new-fangled technology (hint hint), you can capture those margins for yourself.

That’s exactly what Twiga did. They choose the right time, the right product while leveraging new technology. But they also had the right team: I met former CEO and co-founder, Grant Brooke at a bar on New Years Eve 2014 in Nairobi. For 4 hours he wouldn’t talk about anything but bananas. On Jan 1st. At 2am. That’s focus.

He had plans to become an MP (Member of Parliament). He didn’t do it, ultimately, but it goes to show he was thinking BIG. Outside the box compared to any other expat founder.

Prior to Twiga, Grant had spent years ?researching? informal markets in KE as a Princeton student. ?Lesson in there for would-be entrepreneurs. Before joining Twiga as CTO, @cwanjau was a serial entrepreneur. In 2014, I had hired his company at the time for a project. Particularly notable was his *integrity.* Much respect for him. I’ve never met the other co-founder, Peter Njonjo. With 20 yrs at Coca Cola and becoming President of Coca Cola West Africa, you might think they had it easy. Not so.

Investors in Kenya initially didn’t see the value of Twiga and gave paltry valuations. They only saw Twiga as a banana distributor, not a software company and brand that could rival Coca Cola or Unilever one day.

Peter provided the initial financing with $350k. Then when other investors didn’t materialize he sold his own house to finance Twiga (true story). Fund manager of Lundin (and my former next-door neighbor), Joy Muballe @jmuballe, presented Twiga to Lundin at the seed raise.. But Twiga was rejected by the Investment Committee. So she decided to fund Twiga herself. That decision would return 10x plus for her when she cashed out after 4 years in a secondary funding round. Twiga realized working with smallholder farmers was too costly. They moved to larger farms. But even those couldn’t provide enough supply and now they have started their own farms.

Team, timing, strategy… but there is one more ingredient: Focus.

“We sell bananas. That’s all.” Grant said. Not avocados, or dried bananas or anything else

“Do something specific about something specific. Once you’re successful at that you can do other things.”

Initially Twiga thought “Bananas are tough, everything else will be easier.” But, each produce has its unique challenge: Bananas need to be ripened; Greens need to be refrigerated; Tomatoes are seasonal with market instability, etc. Only now has Twiga expanded to other products like cooking oil and flour.

Only now has Twiga started to expand to tier 2 cities like Kakamega and Kisii and internationally.

Lesson: ?focus? While international aid organizations pressure startups to expand to new countries (don’t get me started!), Twiga at $25m annual revenue, $92m investment and 7 years of experience is still expanding in Kenya.

The timing was ripe: If Twiga hadn’t, someone else would have. Other fruit aggregators are also experiencing massive growth in by adding software @EAFruits ??, @niledotag ??, @khulaecosystem ??, @TaniHubID (Indonesia), @ninjacart (India). Honestly, I’m surprised there aren’t more software-enabled fruit&veg aggregators in Africa. Every country needs one. ?Huge Opportunity.? Parting thought: “Martin Luther King didn’t say “I have a plan” Grant said. “He said ‘I have a dream.’ We had a dream and we hired the people to figure out the plan.” ?Avoid Analysis Paralysis.? If you’re thinking “It’s hard for accomplished people to succeed, why should I even try?” Then please subscribe because the next case study is about an African entrepreneur who had none of these advantages and still succeeded. Stay tuned.

If that was useful to you, consider subscribing to our newsletter for more case studies.

0 Comments

|

AuthorKyle founded Grant&Co after running a biogas company in Kenya for 5 years. We raised a lot of grant capital there. And now we help other entrepreneurs raise capital. Archives

November 2022

Categories |

RSS Feed

RSS Feed