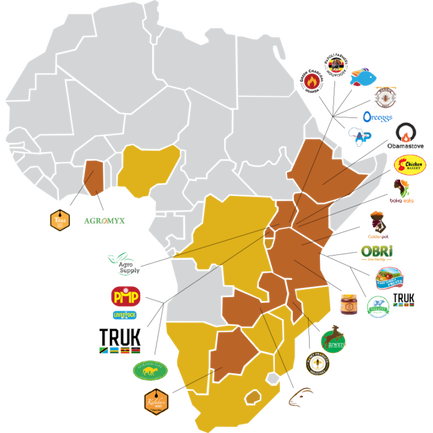

See below for the quick profiles on the entrepreneurs in our network rapidly expanding and looking for partners on their social impact journeys.Interested in learning more? Enter your email and we'll send you their pitch decks and get you in touch with their CEOs.

|

|

|

A permanent capital vehicle dedicated to funding “the Missing Middle” of African agribusinesses: growing companies from less than $50,000 in annual revenue to more than $1 million.

|

Seeking $7M (on top of the $9M raised to-date) in order to invest in additonal equipment for portfolio companies, provide working capital and invoice financing loans, double the value of the portfolio/balance sheet, grow 10X in less than 4 years, and prepare for a Nairobi or Mauritius IPO.

|

Helping farmers upcycle sugarcane waste in order to

- Increase income and livelihood - Conserve African forests & biodiversity - Sustainably fuel homes, schools, & industry Since Q4’22 VUMA has launched two new products, doubled production capacity, and increased monthly revenue by 4X. Within the next 5 years, they expect to upcycle 350,000 tons of sugarcane waste, save 1.6 million trees (sequestering 35,000 tons of CO2) and create 200+ jobs in rural communities in Kenya, alone.

Seeking $500k in equity or convertible debt bridge funding to accompany a pipeline of grants, launch a biochar producti and reach EBITDA+ in Q1 2024 |

A FinTech & financing platform leveraging data to:

- Digitize microretailers - Help BOP business owners access finance to grow - Organizations create their own embedded finance Since 2019, Flow has faciliated over 283,000 liquidity advances (worth >$71 million) while retaining a 99.78% loan repayment rate (even throughout the pandemic). They've raised over $4M in financing from the likes of UNCDF, SCBF, and DEG while heling their customers increase their income by an average of 40% in 6 months and growing 4X YOY.

Seeking $3M in equity to take MMR to >$1M within 18 months, grow current portfolio in Uganda and Rwanda, expand to new markets, and build BaaS services. |

|

A Unified Solution for Outsourced Clinical Research

A service and tech (platform) oriented social enterprise connecting Pharma and Academia with participants, sites, data, analytics, and other clinical research services, whether specimen collection, consulting on regulatory issues, or site feasibility studies. |

A Kenyan startup on a mission to fight malnutrition, ensuring East African families receive low-cost breakfast and dairy foods right to their doorstep, while revolutionizing what they see as an ineffective supply chain. Their asset light model results in long-term productive relationships with farmers where they see faster payments (weeks or months before others in the space) and 10%+ more income on their sales, as well as the means for unemployed youth to start microenterprises and build resilience in their communities.

Food and Us now serves 20,000 customers daily (both through direct Whatsapp channels and 5,200+ retail outlets), works with 900+ local farmers, and is growing 27% YoY. |

AfricanFinancials manages the digital infrastructures and provides full-service online investor relations for African public companies with functional dashboards, so that they are in compliance and attract more investors with sustainability metrics.

They plan to leverage data and AI to grow their central portal of information to cover every listed company in Africa, benefitting stakeholders, investors & companies, while driving innovation in sustainable capital creation.